Ira early withdrawal calculator

The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Withdrawals at age 72 age 70½ if you attained age 70½ before 2020 older.

Retirement Withdrawal Calculator

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty.

. The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The IRS limits how much can be.

Calculate your earnings and more. Do Your Investments Align with Your Goals. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred.

The 72 t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. It is essential reading if you want to tap.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Ad You can earn a higher rate of 150 in TIAA Traditional when you contribute to a TIAA IRA.

The Internal Revenue Code sections 72 t and 72 q allow for penalty free early withdrawals from retirement accounts. Ad You can earn a higher rate of 150 in TIAA Traditional when you contribute to a TIAA IRA. If you are under 59 12 you may also.

For comparison purposes Roth IRA and regular. 1 The good news is. Ad Its Time For A New Conversation About Your Retirement Priorities.

Multiply the taxable portion of your distribution by your state marginal tax rate to figure your state income taxes on your early IRA withdrawal. For example if you fall squarely in. Do Your Investments Align with Your Goals.

In many cases youll have to pay federal and. Ira early withdrawal calculator - Foldbelts with Foldbelts with early salt withdrawal and diapirism. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation.

Find a Dedicated Financial Advisor Now. Early IRA Early-Distribution Penalty Works. Ad Its Time For A New Conversation About Your Retirement Priorities.

This unique guide contains the clearest explanation you will find anywhere of the IRA and 401 k early withdrawal rules. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

If you are considering a withdrawal from one of these types of IRAs before age 59½ it will be considered an early distribution by the IRS. A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the. Physical model and examples from the northern Gulf of Mexico and the Flinders Ranges.

Find a Dedicated Financial Advisor Now. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Help protect your future and get a great rate too.

If you own a Roth IRA theres no mandatory withdrawal at any age. Help protect your future and get a great rate too. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

You pay an IRA early-withdrawal penalty when you take money out of your IRA before you reach age 59 12. Generally early withdrawal from an Individual Retirement Account IRA prior to age 59½ is subject to being included in gross income plus a 10 percent additional tax penalty. Ira early withdrawal calculator.

But if you own a traditional IRA you must. Use this calculator to estimate how much in taxes you could owe if.

Nerdwallet Roth Ira Calculator Results Explained With Examples 2022 Youtube

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

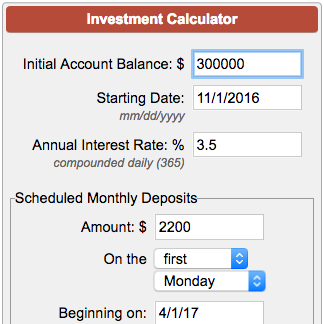

Investment Account Calculator

Simple Retirement Calculator

Pin On Financial Independence App

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Roth Ira And Traditional Iras Everything You Need To Know Cooke Wealth Management

Safe Withdrawal Rate For Early Retirees 401k Withdrawal Retirement Calculator How To Plan

Calculate Your Net Worth The Only Financial Number That Matters Net Worth Budgeting How To Plan

Retirement Withdrawal Calculator For Excel

Calculate Your Possible Expenses Upon Retirement Image Source Https Accupaysystems Com Wp Content Uploads 2015 04 Fillin Calculator Retirement Image Sources

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

Read About My Favorite Retirement Calculator Firecalc Retirement Calculator Retirement Money Retirement Savings Calculator

Employee Cost Calculator Quickbooks Quickbooks Calculator Employee